Auction Designer

AURES Auction Designer

Summary of selections

AURES AUCTIONDESIGNER

Thank you for using the AURES Auction Designer. Please find below a summary of your selections and related feedback.

Choose a country

About the Auction Designer

In the renewable electricity sector, auctions are becoming an increasingly common mechanism to allocate support payments to new projects. Given the wide range of technologies and of market characteristics across different countries, there is no one single auction design to be recommended to policy makers. Designing well-performing auctions for renewable electricity support is a challenge for policy makers and requires a good understanding of the market, of one’s own policy objectives, of auction design elements, and of how all these factors affect bidder behaviour.

The AURES Auction Designer navigates you through the main questions that need to be answered when designing an auction for renewable electricity in your country, and illustrates the effects of major design elements on auction performance, all based on the insights from the AURES project.

If you are a policy maker, this tool will support you in designing a well-functioning auction for your country by pointing out the main issues, information needs, as well as best practices and typical pitfalls.

If you are from energy industry, an environmental organisation, or a different stakeholder group, this tool can help you to understand the logic behind auction design and the trade-offs faced by policy makers in your country, and therefore enable you to participate in policy discussions in a well-informed manner.

When running the design tool you will have to answer a number of questions. You can start right away, but it is advisable to prepare some answers beforehand in order for our recommendations to be most useful for your situation. Download our info sheet to find out which information we will ask you.

Winners' Curse

The Winner’s Curse occurs when a winning bidder unintentionally underestimates his true costs. In reality, bidders do not know their exact costs prior to the auction. Some cost components are unknown and only the probability distribution of the costs is common knowledge. Usually this unknown cost component is common to all bidders. An example might be future PV module prices. The bidders do not know these costs exactly, but they make an estimate. Furthermore, all bidders need modules, so this cost component affects them all. Under such circumstances, the Winner’s Curse will occur if the winning bidder wins the auction not because he actually has the lowest costs, but because he has the most optimistic estimate for the unknown costs and hence the lowest bid. The estimate is most probably below the actual costs (being the lowest estimate) and hence the winning bidder may make a loss. Theoretically, rational bidders include this risk in their bid and the Winner’s Curse does not occur. In practice however, it does occur. The lower the support level resulting from the auction, the higher the probability of the Winner’s Curse under the assumption that the same bidder wins the auction. Winning projects struck by the Winner's Curse face a high risk of non-realisation.

The auctioneer should thus implement pre-qualifications and penalties.

Sunk Cost

RES developers face expenses for project pre-development. This pre-development is usually obligatory to participate in the auction. The expenses incurr independent of the auction outcome and are therfore regarded sunk costs as they cannot be recovered.

Read more

RES developers face expenses for project pre-development. These include measuring the availability of the resource (e.g. wind speeds, solar irradiation), environmental impact assessments, geological surveys, grid connection issues, and more. Depending on how the auction is designed, auctioneers must pre-develop their project to differing degrees before they can enter it into an auction. The costs for pre-development are sunk costs, meaning that they will not be recovered by the project developer. This is obvious in the case of projects which are not awarded: The installation will not be built, and the pre-development was thus in vain. However, the same can be true even of awarded projects: Assuming sufficient competition, rational bidders will not include past costs in the calculation of their bid price. Even auction winners therefore do not recover their pre-development costs.

Implicit Collusion

Collusion refers to bidders communicating with each other without the knowledge of the auctioneer in order to obtain an auction outcome more favourable to them. While explicit collusion is commonly prohibited by law, it can be observed in real-world applications that bidders succeed to circumvent the law by implicit collusion, i.e. by communicating via hidden clues. A famous example of implicit collusion is the auction for telecommunication licenses in Germany in 1999, where bidders succeeded to communicate via number combinations in their bids: "Vodafone–Mannesman ended a number of its bids with the digit “6” which, it was thought, was a signal that its preference was to end the auction quickly with six remaining bidders.” (Klemperer, 2002a) (Klemperer, 2002b)

Klemperer, P., 2002a. How (not) to run auctions: The European 3G telecom auctions. European Economic Review 46, pp. 829-845.

Klemperer, P., 2002b. What really matters in auction design. Journal of Economic Perspectives, Vol. 16, No. 1, pp. 169-189.

How is the auction volume defined?

The auction volume can be defined in terms of capacity (MW), generation (MWh), or budget.

Auction volume determined in terms of capacity (MW)

When the target volume of an auction is expressed in terms of installed capacity, the auctioned good is in most cases also defined in terms of capacity. A bidder thus commits to installing the offered capacity within the specified realisation deadline. It is less common, but also possible to define the auctioned good in terms of generation. A bidder thus commits to delivering a certain amount of electricity per year for the duration of the purchase contract.

From the viewpoint of a policy maker, a capacity target volume provides less ex-ante security on total policy costs, compared to a budget-based auction target. However, by setting an appropriate ceiling price, it is possible to contain this risk. Auctions with capacity-based target volumes provide a good planning environment for the whole electricity sector and enable easy monitoring regarding the achievement of RES policy targets. This is especially true if policy targets are formulated in terms of capacity, but also applies to generation-based policy targets. From the perspective of an awarded bidder, committing to the realisation of a certain capacity, rather than generation, comes with fewer uncertainties.

Denmark, France, Germany, Ireland, Portugal, California, China, and South Africa have applied capacity-based target volumes in their auctions and have defined the auctioned good in terms of capacity as well. Brazil has applied the less common combination of defining its target volume as capacity, but the auctioned good in terms of generation.

Auction volume determined in terms of generation (MWh)

Generation-based targets are unusual, but two options are possible in principle: I) the auction volume is set in terms of actual generation over the course of a given time frame (or an actual annual average); or ii) annual generation is estimated by combining standardised technology-specific annual full-load-hours with installed capacities. When the target volume of an auction is expressed in terms of generation, the auctioned good can be expressed either in terms of generation or capacity. Bidders therefore either commit to delivering a certain amount of annual electricity generation over the contract duration, or to installing a certain capacity by the end of a given realisation deadline. We consider the former case to be the more coherent and realistic one.

From the viewpoint of a policy maker, a generation target volume provides less ex-ante security on total policy costs, compared to a budget-based auction target. However, by setting an appropriate ceiling price, it is possible to contain this risk. Auctions with generation-based target volumes provide a good planning environment for the whole electricity sector and enable easy monitoring regarding the achievement of RES policy targets, especially if these are formulated in terms of a share of total electricity generation.

For bidders, committing to the delivery of a certain annual generation volume is more risky than committing to the installation of a certain capacity, as weather conditions may fluctuate across years. The regulator should thus define a range (minimum and maximum) of annual production delivery, possibly combined with banking and borrowing options.

Auction volume determined in terms of budget (€)

When the target volume of an auction is set in terms of a maximum budget, the auctioned good is usually either expressed in terms of generation or capacity. Bidders therefore either commit to delivering a certain amount of annual electricity generation over the contract duration, or to installing a certain capacity by the end of a given realisation deadline.

A budget target volume clearly sets an upper limit for support expenditures, thus providing security on policy costs for the regulator, and ultimately, electricity consumers. However, with a budget cap it is unclear ex-ante how much capacity will be installed as a result of each auction round. This makes planning in the electricity system more difficult. It also means that the achievement of policy targets (which are usually expressed in terms of installed capacities or shares of total electricity production) is more difficult to monitor. This can mean both under- or overachievement of policy targets. Budget caps are thus less straightforward to be deduced from existing policy targets and must be constantly monitored and readjusted according to technology cost developments.

The Netherlands, Italy, and the UK have used budget-based auction targets. The size of bidding projects was defined in terms of capacity in all cases.

All of these options have benefits and drawbacks.

In principle, all options can be combined with any remuneration award metric (FIT, FIP, or investment grant), but not all combinations are equally sensible in reality. By far the most common option is the combination of a capacity target volume with a generation-based award metric, usually a FIP. See also the related AURES policy memo.

For the purpose of this questionnaire, we define the auction volume in terms of installed capacities.

Winners' Curse

The Winner’s Curse occurs when a winning bidder unintentionally underestimates his true costs. In reality, bidders do not know their exact costs prior to the auction. Some cost components are unknown and only the probability distribution of the costs is common knowledge. Usually this unknown cost component is common to all bidders. An example might be future PV module prices. The bidders do not know these costs exactly, but they make an estimate. Furthermore, all bidders need modules, so this cost component affects them all. Under such circumstances, the Winner’s Curse will occur if the winning bidder wins the auction not because he actually has the lowest costs, but because he has the most optimistic estimate for the unknown costs and hence the lowest bid. The estimate is most probably below the actual costs (being the lowest estimate) and hence the winning bidder may make a loss. Theoretically, rational bidders include this risk in their bid and the Winner’s Curse does not occur. In practice however, it does occur. The lower the support level resulting from the auction, the higher the probability of the Winner’s Curse under the assumption that the same bidder wins the auction. Winning projects struck by the Winner's Curse face a high risk of non-realisation.

The auctioneer should thus implement pre-qualifications and penalties.

Implicit Collusion

Collusion refers to bidders communicating with each other without the knowledge of the auctioneer in order to obtain an auction outcome more favourable to them. While explicit collusion is commonly prohibited by law, it can be observed in real-world applications that bidders succeed to circumvent the law by implicit collusion, i.e. by communicating via hidden clues. A famous example of implicit collusion is the auction for telecommunication licenses in Germany in 1999, where bidders succeeded to communicate via number combinations in their bids: "Vodafone–Mannesman ended a number of its bids with the digit “6” which, it was thought, was a signal that its preference was to end the auction quickly with six remaining bidders.” (Klemperer, 2002a) (Klemperer, 2002b)

Klemperer, P., 2002a. How (not) to run auctions: The European 3G telecom auctions. European Economic Review 46, pp. 829-845.

Klemperer, P., 2002b. What really matters in auction design. Journal of Economic Perspectives, Vol. 16, No. 1, pp. 169-189.

Uniform Pricing Rule

Multiple-item auctions can be designed so all winning projects receive the same price (uniform pricing, also known as pay-as-cleared), or with discriminatory pricing, for instance so all winning projects receive their bid price (pay-as-bid).

Read more about pricing rules on the next page.

Ceiling Price information

Ceiling prices define the maximum support level and act to mitigate excessive producer rents in case of low or limited competition in the auction.

Calculating ceiling prices and price adjusting

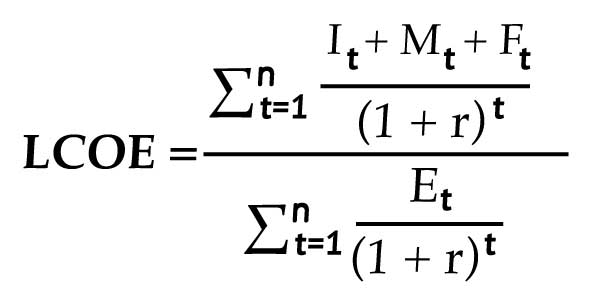

There are two main options for calculating ceiling prices: based on an assessment of generation costs (LCOE) or based on a calculation of opportunity costs. An LCOE-based technology specific approach is the best methodology to calculate ceiling prices. Compared to an opportunity cost approach, it provides a realistic production costs assessment. In the LCOE-based approach, the ceiling price is set at or slightly above LCOE level. LCOE should be calculated from the perspective of a typical investor.

Consequentially, the methodology should take the broader regulatory framework and transaction costs into account (taxes and tax exemption, market risk premiums, financing conditions etc.). As auctions increase risks for investors (as compared to administratively set support) the LCOE calculation should also account for this risk – otherwise the ceiling price may become too stringent and thereby impede competition. Adjustment of ceiling prices on a regular basis is likely to be required as LCOE of renewables develop.

In an auction scheme, there are three possible procedures to adjust prices. First, an administrative authority could recalculate the LCOE and the ceiling price on a regular basis. Second, the ceiling prices could be indexed to economic indicators (such as steel prices etc.) and changed automatically or by discretion of the auctioning authority. Third, ceiling prices could be adjusted based on the auction outcomes of previous rounds. The first option involves regular transaction cost but is well established in many EU Member States with feed-in tariffs, the second option requires higher transaction cost to set up the methodology and the third option requires some attention to avoid strategic bidding. A suggested ceiling price calculation is given below:

- LCOE = Levelised cost of electricity

- It = Investment in the year t

- Mt = Operations and maintenance expenditures in the year t

- Ft = Fuel expenditures in the year t

- Et = Electricity generation in the year t

- r = Discount rate

- n = economic lifetime of the system

Bid bonds/financial pre-payments in combination with fixed penalty

The measure

Bid bonds and financial pre-payments usually come in combination with a

fixed penalty. An interested bidder has to prequalify either by

delivering a bank guarantee (bid bond) or by placing cash in a

designated account (financial pre-payment). If the bidder is awarded,

but the contracted project is delayed or not completed, the money is not

returned to the winning bidder. This fixed amount thus constitutes a

penalty. The bid-bond may at the same time serve as an indication

of the bidder's financial competence (see section on bidder

restrictions). In case of multi-item auctions, it is common to set

the financial prequalification as an amount per kW capacity offered in

the bid, while the financial prequalification in single item auction can

be set regardless of project capacity. A financial prequalification can

also be divided into two steps, with a first bid bond/payment due

before participating in the auction, and the second bid bond/payment due

after being awarded.

Real-life examples

Bid bonds applied in different auction schemes:

- Portugal, Wind and biomass: €10/kW for first bid bond, €25/kW for second

- Germany, Solar PV: €4/kW for first, €50/kW for second

- Spain,

On-shore wind and biomass: in case of non-compliance by the agreed date

(48 months after being awarded), the contracting authority would

enforce the bank guarantees of 20€/kW.

- Italy, Multiple technologies: 5% of estimated investment costs as first bid bond, 10% of estimated investment cost as second bid bond

- Croatia, Multiple technologies: 50 HRK/kW (approx. €6.5) for first bid bond, 300 HRK/kW (approx. €40) for second

Denmark: In the Danish offshore wind auction of Anholt a fixed penalty was charged in case of delayed grid connection of the last turbine. The penalty was between DKK 100 and 400 million (€ 13.4 and 53.7 million) depending on the timing of the delay announcement. Combined with a reduction in support level in case of delayed grid connection of the first turbine, the penalty has been considered the main reason for poor auction participation (the auctioneer received only one bid)

Additional penalties

Apart from the above mentioned bid bond/financial pre-payment which is not paid back to the bidder in case of non-realisation or delay, there are other forms of penalties:

1) Penalty in the form of reduced support payments

The measure

When a project is delayed, an alternative to fixed penalties can be a

reduction of the support level that was awarded to the project in the

auction. In this way the penalty payment is postponed until the

installation starts generating revenue, and it is furthermore spread out

over a longer period of time. In case a project is not realised at all,

the complete support is withdrawn.

Effect on auction outcome:

With a reduction of support level the negative impact of a fixed penalty

on the company’s liquidity can be avoided. The postponement of the

penalty payment is therefore less likely to result in default and

non-completion of projects; however, like fixed penalties, the risk of

reduced support level is likely to increase bid levels.

Setting the support level reduction appropriately can be challenging. On

the one hand, a too high support reduction in case of delay can render

the project unprofitable, and the bidder may choose non-completion

instead of realising the project with delay. Non-realisation carries no

penalty under this measure. On the other hand, too little reduction will

have no effect.

Real-life examples:

In the Italian multi-technology auction schemes, the awarded FIT or alternatively FIP are reduced by 0.5% for each month of delay. After a tolerance of 12-24 months, the FIT and FIP contracts are withdrawn.

If projects awarded in the German auction scheme for ground-mounted solar PV are not commissioned within a period of 18 months, the FIT decreases by €0.3 cent / kWh.

2) Penalty in the form of reduced support period

The measure:

In case of delayed realisation of awarded projects, the duration of

support is reduced. Like fixed penalties and reduction of support level,

support period reduction creates an incentive for completing the

project on time. Compared to the other two measures, the penalty payment

is postponed even further. The support period reduction can be defined

for instance relative to the delay period, or by setting a fixed date

for discontinuation of support payments, implying that late completion

will lead to an overall shorter support period.

Effects on auction outcome:

Due to the postponement of the financial implications of the delay

penalty, reduction of support period has less negative effect on the

liquidity of the project developer in case of delay. This penalty type

is therefore less likely to cause default before completion of project,

compared to fixed penalties or support level reduction. The penalty

creates incentives for completing the project because the project

developer would still like to avoid delay penalty, but is less likely to

reduce the number of bidders compared to fixed penalties enforced when

delays occur.

Real-life examples:

In the French auction scheme for solar PV, support duration is reduced by the delay, multiplied by 2. The installation has to be connected 18 months after publication of the auction results.

In Ireland, the 15-year PPAs offered under AER V and AER VI schemes will not extend beyond the end of 2018 and 2019, respectively. Projects which came online too late will therefore not be able to make use of the full duration of the contract. Similarly, the 10-year PPAs given to biomass CHP projects cannot exceed the end of 2016.

3) Penalty in the form of exclusion from future auctions

The measure:

In case of non-compliance or misconduct, bidders can be excluded from

future auctions for a certain period of time. The exclusion can either

be of the bidding project or the developer itself. If exclusion is used

as a penalty, it is important that exclusion together with

pre-qualification requirements are defined in a way that does not offer

an possibility to circumvent exclusion, for instance by redefining the

project or transferring project ownership.

Effects on auction outcome:

Exclusion provides an incentive for avoiding non-compliance; hence it

promotes increased seriousness of bids. In case pre-qualification costs

are very high, exclusion can be very costly to the project developer, as

it can prevent them from reusing the same project in following auction

rounds. However, compared to the case of fixed penalties, exclusions are

less likely to reduce the number of potential bidders, as it can be

more difficult to quantify the value of exclusion. It is therefore less

likely to increase support level compared to fixed penalties.

Real-life examples:

In the auction scheme in the UK, the primary penalty is the exclusion of any project on the same physical location from future auctions for a period of thirteen months. The project developers can be penalised either if being offered a support contract and refusing to sign it or if signing a support contract and failing to deliver the project.

In the Dutch auction scheme, an awarded project under SDE+ loses its support right and is excluded from participating again for a period of 3 years, if the project is not operational within the realisation period (3-4 years). However, in some cases it is possible to work around this exemption by “redefining” the project (e.g. by changing the capacity or the location) and apply again.

4) Production-related penalties

The measure:

Production related penalties can be imposed in cases where the

production of contracted and finalised installations deviates from what

was indicated in the project bid, e.g. in terms of generated

electricity. In situations where contracted installations produce less

than expected, the security of supply in the power system may be

challenged. This should therefore be avoided. On the other hand, if

remuneration is awarded by generated kWh, too much production may lead

to support budgets being exceeded.

The penalty level can be either fixed or for instance based on the deviation from expected/contracted production or support costs, and may include exclusion from future auctions. The duration over which the production deviation is calculated is an important parameter to consider when designing the penalty.

Another variation of production related-penalties are those enforced when deviations from the contracted production method occur. This is relevant for instance in biomass based power generation, where penalties can be imposed if the consumed fuel does not live up to the fuel mix specified in the pre-qualification criteria.

Effects on auction outcome:

Penalties for lower-than-expected power generation increases the risk of

the investor and is therefore likely to increase support levels. This

is particularly valid in auctions for variable RES technology

installations such as wind farms and solar PV, where the generation is

greatly dependent on local conditions and may vary from year to year.

Likewise, penalties for excess production increase the risk of the bidder and may also increase support levels.

Production-related penalties are an incentive for bidders of variable

REs technology projects to obtain a proper understanding of the

location, for instance wind speeds and duration which are needed to

determine the output of wind power plants. While this may reduce the

number of interested bidders, the quality of the bids is

increased.

Real-life examples:

The Polish on-shore wind power scheme includes a penalty for production deficit, i.e. failing to deliver the full contracted electricity volume. Delivering less than 85% of the offered volume in a settlement period of 3 years will result in a financial penalty at the rate of 50% of the awarded price times the total undelivered electricity.

In the proposed (as of 2016) Croatian auction scheme, fines of HRK 1,000.00-50,000.00 can be imposed in case the contracted producer fails to maintain the technological requirements needed for obtaining the status as eligible producer, fails to submit the required documentation, fails to maintain metering equipment, or conducts changes in installations without prior consent.

Bidder restriction

Bidder restrictions are requirements to the bidders, rather than to a specific project.

Such restrictions may be used to filter out any type of bidder, depending on the policy maker's objectives. Here, we shall look at restrictions which aim to allow only competent and capable bidders to participate in the auction:

1) Restrictions/requirements regarding the developer's experience

The measure:

Ensuring that project developers have experience with similar projects

may be a way to reduce risk of delay and non-completion. It is thus a

typical pre-qualification requirement, in particular in auctions for

large and complex projects. The developer experience could be expressed

in terms of current installed capacity, or educational level and tenure

of the personnel.

Real-life examples:

In the Danish

off-shore auction for Horns Rev 3, bidders needed to present one

reference of operation and maintenance of an offshore wind farm with an

installed capacity of minimum 25 MW. Furthermore, reference of

development and management of construction of offshore wind farms for at

least one wind farm with a minimum size of 100MW was a requirement for

qualifying for auction participation. As a result, mainly big,

experienced energy companies took part in the auction.

In Portugal,

proof of technical capability was required for participating in the

auction for RES support. Technical capability was presumed if the bidder

had at least 30MW of installed capacity under exploitation at the time

of bid submission.

2) Restrictions/requirements regarding the developer's financial competence

The measure:

Financial robustness of the bidding company can be used to mitigate the

risk of the winning bidder failing to find the necessary funding or even

filing for bankruptcy before the project is realised. The criterion can

be designed as a restriction, for instance by allowing only companies

with a minimum credit rating or annual turnover to participate in the

auction. Aditional requirements ,such as a proof of funding in

terms of loan commitments can also be used as a pre-qualifying criterion

ensuring efficient means of the bidder to complete the project.

Ristrictions regarding financial competence are usually accompanied

with financial prequalifications, i.e. bid bonds, and

material pre-qualifications related to the project development stage,

which in combination increases the probability of project

realisation.

Effects on auction outcome:

Strict requirements regarding rating and turnover can reduce the number

of especially small project developers in the auction. In this way

competition may be reduced resulting in higher support levels. Criteria

regarding financial competence can be particularly difficult

for citizen cooperatives and other small actors to live up to,

and may therefore appear as an entrance barrier and reduce the

actor diversity.

Real-life examples:

Denmark:

In the off-shore wind power auction Horns Rev 3 in Denmark a letter of

intent was required from a financial institution of a demand guarantee

of DKK 100 million. Moreover, the project developer needed to have a

minimum annual average turnover of DKK 15 billion (€2 billion) over the

last 3 years. Finally the bidders were required to have an equity ratio

of 20% or above, alternatively have a long term debt rating of BBB or

above (Standard & Poor’s and Fitch) or Baa3 or above (Moody’s).

3) Restrictions/requirements regarding the developer's history of good conduct.

The measure:

Pre-qualification related to good conduct of the developer may include

many different aspects. For instance, the auctioneer may require that

the bidder has no (or limited) tax debt or that the project managers

have a clean criminal record. Another way of promoting good conduct

is to require certain management certification.

Effects on auction outcome:

Requirements regarding the history of good conduct may work as a

restriction for auction participation, reduce the number of participants

and, potentially lead to increased support costs. If, however, the

requirements can be fulfilled at a cost for the bidder, it would add to

the pre-qualification costs, hence increase the sunk cost in case the

bidder loses the auction. To increase chances of winning the bidders may

bid more aggressively.

Real-life examples:

Denmark: In the Danish off-shore auction scheme potential bidders were disqualified if their public debt was more than DKK 100,000.

Croatia

(proposed, as of 2016): In order to participate in the proposed Croatian

scheme a bidder must document that they have paid all required taxes,

health insurances and pensions for employees, as well as produce a

certified statement, ensuring that the person responsible for the bid

has not been convicted of bribery, fraud or similar crimes.

Alternatively, bidder restrictions may be used to implement a secondary policy goal by, for instance, allowing only bidders of a certain size, with a certain ownership structure, or from a certain region to participate in the auction. See the section on secondary objectives for more information.

Prequalification requirements regarding project development stage

The measure

Prequalification requirements regarding the project development stage are intended to ensure that all bidders are serious and have a sound understanding of their project. Moreover the requirements can help prevent occurrences of unforeseen obstacles, which may otherwise result in delays or non-realisation of projects. The required documentation is typically a detailed project description, grid access guarantee, land tenure, environmental permits and construction permits. For small installations, more relaxed requirements are also possible.

Real-life examples

The Irish

AER III auction suffered from low realisation rates. While part of the

winning bidders had difficulty obtaining planning permission and their

projects were thus not realised, there were at the same time significant

potential wind park capacities holding planning permission but not an

AER contract. In order to address this problem, the following auction

rounds required all bidding projects to have secured planning

permission. Later auction rounds also required bidders to hand in an

indicative cash flow statement showing that the proposed project could

at least break even.

In the Dutch

SDE+ scheme, project developers are required to present a written

permission of the owner of the location/land, a (technical) description

of the installation, and a feasibility study in order to qualify for

participating in the auction. Furthermore, an environmental permit, and

for geothermal projects also an exploration permit and completed

geological survey, is needed.

In the Italian

auction scheme bidders need to have a building permission or concession

as well as a connection offer from the grid operator formally accepted

by the plant owner.

Actor diversity

Policy makers can have an interest in favouring a certain mix of actor types, for instance one with a minimum share of small or local actors. Such considerations are often connected to public acceptability concerns, as small and local actors are expected to be more rooted in the communities affected by renewables installations, thus making them more acceptable to the public. A regulator can also have an interest in keeping actors diverse in order to ensure high competition in the market in the long run. Here, we focus on small actors, as this is the most common group to receive favourable treatment. There will always be an incentive for all actors to fall into the favoured category. A careful legal definition of the favoured actor category is thus crucial to prevent non-eligible actors from slipping in.

Specifically, small actors tend to have the following two problems:

- they can have systematically higher generation costs than large actors, due to their lacking economies of scale. However, this is not necessarily true for all technologies in all markets and thus needs to be explored by each policy maker in detail;

- they are not able to spread their risks as well as large actors due to their typically smaller project portfolio. This constraint applies to varying degrees for varying technologies and is especially true for technologies in which larger projects are the norm. Small actors with the capacity to develop only one or very few projects may be deterred from this by the risk of their project not being awarded in the auction, leaving them unable to spread their sunk costs over a large portfolio.

Small actors can be defined along the following lines:

a) Definition by actor characteristics

Description:

The bidder developing the project is classified as a small actor by criteria such as their shareholder structure, frequency of developing projects, or whether they fall into the SME category according to the European Commission recommendation (L124/36).

Germany provides preferential treatment in wind auctions for citizen cooperatives, by which a citizen cooperative is defined as being owned by at least 10 local natural persons with together 51% of voting rights, developing a maximum of one project per year (BMWi, 2016). Another example is France, where bidders in the PV auctions must be the owner of the building and maintain the installation.

Assessment:

For the SME definition to be applicable, interconnections between the entity holding project ownership and possible larger mother companies must be identifiable to the regulator. There is also a danger of large players transferring ownership of a RES project to SMEs just before the auction with the specific purpose of receiving special treatment. Such strategic behaviour must be prevented, for instance by requiring the entity that holds project ownership to be classified as an SME at least from the auction to project realisation.

Conflicts with EU laws and regulations are possible, as in the case of generation-based support, state aid regulation refers to exceptions for small installations rather than small actors. In addition, favouring “local” persons may also be problematic from a legal view.

b) Definition by project size (de-minimis-threshold)

Description:

The current state aid regulation already foresees a de-minimis threshold, allowing RES installations of less than 1 MW, or less than 6 MW/less than 6 generation units in the case of wind, to receive support without going through a competitive bidding process (European Commission, 2014, Art. 42).

Assessment:

This definition assumes that a correlation exists between small installations and small actors. At least for wind projects in Germany, such a correlation could not be confirmed (Grashof et al., 2015). A definition by project size is thus not suitable to achieve the aim of favouring small actors. For other technologies or markets, the degree of correlation would need to be explored before putting in place a de-minimis definition. However, de-minimis rules might be adequate measures for pursuing other policy goals such as limiting transaction costs of the auction etc.

c) Definition by potential frequency of auction participation

Description:

In any given year, an actor may potentially participate in auctions with all those projects which have obtained the necessary material pre-qualifications (i.e. building permits etc.). Large actors will usually have more such projects in their portfolio per year than small actors.

Assessment:

The frequency of participation correlates strongly with the actor’s risk

of being awarded, which is especially high for small actors with just

one or very few projects. The criterion is thus well suited to identify

the group that should be favoured. However, the criterion is also prone

to misuse, as large mother companies will have an incentive to hide

their affiliation with small project companies in order to ensure

favourable treatment for them. To address this, small actors could for

instance be asked to register with the regulator and be subjected to

random examinations to ensure their eligibility for small actor status.

However, such a process requires time and resources.

d) Definition for single projects

Description:

Similar to the definition by auction frequency, it is also possible to

allow a small actor to get favourable treatment for one single project.

Such a definition would benefit citizen cooperatives which exist just to

realise one specific project in their area.

Assessment:

The number of actors covered by this definition is expected to be small.

Many small actors have more than one project and would not benefit from

beneficial treatment. Small multi-project actors would have to enter

full competition with their second project, which would only delay but

not remove the barriers they face.

Once your actor group is clearly

defined, in order to include actor diversity as a secondary objective in

your auction, you can implement the following design elements:

1) Reduced financial pre-qualification (penalty) for small actors

Financial pre-qualifications deposited by auction participants usually serve as penalties, as they are not paid back to winning bidders who do not realise their projects in time. Such pre-qualification requirements can be reduced for small actors. For this purpose, financial pre-qualifications may either be split up in two steps, by which a small actor deposits only a small amount at first and the full amount only upon winning; requiring no pre-qualification at all without penalising them for non-realisation; or requiring no pre-qualification and applying alternative penalties (reduction of support amount or duration) for non-realisation.

2) Reduced material pre-qualifications (building permits, grid access,…)

Small actors may enter the auction with reduced material pre-qualifications such as complete building permits or grid access guarantees at their chosen sites.

3) Differentiation of pricing rules for small and large actors

Small and large actors participate in the same auction. While the uniform-price (lowest rejected bid) rule is applied to small actors, the pay-as-bid pricing rule applies to all others. This measure is based on the assumption that small actors are more risk-averse and have access to less market information to judge competition levels.

4) Contingents for small actors

A minimum share of the auction target volume is reserved for small actors, even if other actors’ prices are lower.

5) Boni for small actors

Winning small actors receive a bonus on top of the price resulting from the auction. An administrative component is thus added to the competitive price finding mechanism.

In addition to the above measures, the auctioneer may choose to offer

advisory services and bid quality control for small bidders.

Alternatively, small actors can be exempt from auctions:

6) Exemption of small actors from auction scheme ; remuneration by an administratively set FIP

The measure:

Small actors are not required to participate in auctions. Instead, they

receive support under a FIP scheme with an administratively set support

level.

Effects on auction outcome:

This measure is suitable to address the risk of small actors of not

being awarded. It also gives small actors good information on what level

of support they can expect, thus reducing uncertainty. The measure can

also be used to support small actors with structurally higher generation

costs than large actors, as support levels can be adjusted by the

regulator.

The regulator will partly lose volume control by exempting actors from

the auction. The number of actors covered by this exemption should thus

be kept small. Auction target volumes may have to be adjusted downwards

to compensate for the deployment outside of auctions. If

administratively set support levels are higher than auction results,

this will drive up total support costs.

The legal feasibility of this measure considering current state aid regulation requires closer analysis.

7) Exemption of small actors from auction scheme ; remuneration at winning price of a previous auction round

The measure:

Unsuccessful actors are partly reimbursed for project development costs

after a project has repeatedly been entered in auctions without winning.

Effects on auction outcome:

The measure reduces the risk of small actors of not recovering their

sunk cost in case of an unsuccessful bid, thus making auctions more

attractive to them. However, setting the reimbursement amount is

extremely difficult. If set too low, the measure has no effect. If set

too high, this will reduce the incentive to develop excellent projects

with good chances of winning. The measure is also prone to abuse, as

actors might buy up bad projects and enter them in the auction just to

receive the reimbursement. This measure is therefore not recommended.

Geographical distribution

In order to include geographical distribution as a secondary objective in your auction, you can implement the following design elements:

1) Contingents for certain location types or regions

A minimum share of the target volume is reserved for projects situated in a certain region or location type which is favoured for the above-mentioned reasons but in which projects tend to have higher generation costs, making them less competitive on price alone. A variation on this measure is to instead define a maximum contingent for non-favoured locations.

2) Pre-qualification criterion for desired location types/regions

Projects can only participate in the auction if they are located in a specific region or a specific location type.

3) Criterion in auction to favour desired location types/regions (boni)

Projects from all locations can participate, but those from the desired locations/regions receive extra points and therefore have a higher likelihood of winning.

4) Reference yield model

Projects from all locations can participate. No specific type of location is favoured. However, difference in resource yield are evened out by higher prices being paid to weak resource locations and lower prices to strong resource locations. All bidders bid a price which is adjusted to an average “reference location”, which makes projects comparable. The actual price paid later to winning projects is determined by whether their actual yield is above or below the reference yield.

Domestic industry development

Policy makers may have an interest in promoting the development of domestic industry, innovation capacity, industrial cluster creation, or to positively influence domestic labour markets. Note that clearly favouring domestically manufactured materials may not comply with laws and regulations which aim to ensure a fair competition between local and imported products. For instance, EU member states are obliged to follow EU internal market regulations which severely restrict their possibilities of subsidising or otherwise favouring their own industries over those of other member states. Openly requiring a minimum local content, for instance, is therefore not an option for RES auctions within the EU.

A number of options exist to influence domestic industry development and labour markets through targeted measures outside of auctions, for instance through the creation of innovation clusters and through training programmes. An analysis of these is not undertaken here. However, targeted measures outside of auctions may in many cases be more cost-efficient and thus preferable to including them in auctions.

In order to include the promotion of the domestic industry as a secondary objective in your auction, you can implement the following design elements:

1) Pre-qualification criterion regarding job and cluster creation

Only those bidders may participate in the auction who can demonstrate a certain contribution to local job and cluster creation. The degree of detail required can differ, ranging from a simple demonstration that such issues have been considered to the provision of verifiable figures on planned staff and input characteristics.

2) Criterion in auction to favour projects which contribute to job and cluster creation

The auction is held as a multi-criteria auction in which positive effects on local supply chains or a desired labour force structure increases the overall score of a bidder. In order to meaningfully asses this criterion, it must be defined in a way that is measurable and comparable among projects, which can be challenging.

System integration

Renewables, especially variable renewable technologies, cause integration costs. These include balancing costs due to deviations from day-ahead production forecasts, grid-related costs due to the location of renewables plants being resource- rather than load-related, and profile costs caused by the tendency of variable renewables to generate at the same time, thus reducing the market value of their electricity (Hirth et al., 2015). At increasing shares of renewable electricity, policy makers have a growing interest in ensuring a low-cost integration of renewables into their energy system. System integration may be ensured by steering the geographical distribution of renewables installations, the timing of their generation, or by subjecting them to forecasting and balancing requirements. Typical measures applied to other parts of the electricity system include requiring conventional plants to generate more flexibly, coupling electricity and heat markets, and introducing demand side response mechanisms.

In order to include system integration as a secondary objective in your auction, you can implement the following design elements:

1) Remuneration award metric sensitive to electricity market prices

Remuneration is paid in the form of a FIP (fixed or sliding) or investment grant based on a reference electricity price (see also AURES Policy Memo 3), thus incentivising producers to design their plants to have low correlation with other plants’ generation profiles. Under current state aid regulation, generation-based support is required to be paid in the form of a FIP in EU Member States.

2) Deep connection cost charging

Bidders are required to bear the full cost of connecting their planned installation to the grid (deep charging approach).

Technical specifications

Policy makers may have an interest in promoting certain technical specifications in an auction, be it technology-specific or technology-neutral. Such specifications may aim to improve environmental impact, innovation impact, or system integration. Examples might include efficient CHP technology in a biomass auction, innovative technologies such as thin-film in a PV auction, certain environmental standards in a hydro power auction, or technical prerequisites for system integration.

Conceptually, treating certain technical specifications separately is no different from differentiating between RES technologies (such as onshore wind, hydro, PV, etc.). Similar pros and cons apply as for technology-neutral vs. –specific support scheme designs: Providing favourable treatment for a certain technological design is a political decision, as the favoured technology is protected from free competition with other, potentially lower-cost options.

This may lead to higher support costs in the short term. On the other hand, the dynamic efficiency of the support scheme can be increased by favouring higher-cost but promising technology segments. for an individual technology segment runs the risk of insufficient competition within that segment. This risk will be more significant for smaller and more specialised technology segments.

In order to include certain technology characteristics as a secondary objective in your auction, you can implement the following design elements:

1) Separate auctions for separate technology classes

Support for the favoured installations type is allocated in a separate auction, in which only installations of this type participate. The principle is thus the same as for auctions limited to a certain technology, for instance PV or hydro.

This measure is of course not applicable if a policy maker wishes multi-technology auctions, in which not only technology classes but whole technologies compete in one single auction.

2) Contingents for technologies with certain specifications

A minimum contingent is defined for installations complying with a certain technical specification.

3) Criterion in auction to favour desired technical specification

The auction is held as a multi-criteria auction in which compliance with the desired technical specification increases the overall score of a bidder.

4) Boni for desired technical specifications

Bidders submit a price offer and receive a bonus if they also comply with the technical specification.

Explanation of Radar Dimensions

| Allocative efficiency. Does the auction award least-cost projects? We assess this by two indicators: Awarding of strong bidders and number of strong participating bidders. | |

| Awarding lowest cost projects. Do strong bidders (i.e. those bidders who can realise projects of the requested type at least cost) win the auction? | |

| Number of participating low cost projects. How many strong bidders (i.e. those bidders who can realise projects of the requested type at least cost) bid in the auction? Does their number increase or decrease as a result of a certain auction design feature? | |

| Effectiveness. Does the auction incentivise renewables projects to be realised? We assess this by two indicators: The participating amounts and the realisation rate. | |

| Participating amounts (MW). How many MW of renewables projects bid in the auction? Does this amount increase or decrease as a result of a certain auction design feature? | |

| Realisation rate. How many auction winners actually realise their project by the end of the realisation deadline? How likely are awarded projects to be delayed or to fail completely? | |

| Socio-political acceptability. Is the auction acceptable politically and to the public? We assess this by two indicators: Awarding of favoured projects and support cost minimisation. | |

| Awarding of favoured projects. Do projects win the auction which have certain features that are desirable for political or social reasons (i.e. small actors, certain locations, etc.)? | |

| Support cost minimisation. How high are the support expenditures incurred by the auction? Support expenditures correspond to the prices awarded in the auction. Does the auction succeed in driving award prices down? (Note that award prices are not to be confused with generation costs.) | |

Sunk Cost

RES developers face expenses for project pre-development. This pre-development is usually obligatory to participate in the auction. The expenses incurr independent of the auction outcome and are therfore regarded sunk costs as they cannot be recovered.

Read more

RES developers face expenses for project pre-development. These include measuring the availability of the resource (e.g. wind speeds, solar irradiation), environmental impact assessments, geological surveys, grid connection issues, and more. Depending on how the auction is designed, auctioneers must pre-develop their project to differing degrees before they can enter it into an auction. The costs for pre-development are sunk costs, meaning that they will not be recovered by the project developer. This is obvious in the case of projects which are not awarded: The installation will not be built, and the pre-development was thus in vain. However, the same can be true even of awarded projects: Assuming sufficient competition, rational bidders will not include past costs in the calculation of their bid price. Even auction winners therefore do not recover their pre-development costs.