On April 3rd 2019, the AURES II consortium and the International Renewable Energy Agency (IRENA) hosted a stakeholder engagement workshop titled “Impacts of auctions on wind energy financing” at WindEurope Conference & Exhibition 2019 in Bilbao, Spain.

The workshop attracted 49 registered participants, including project developers and financial industry stakeholders.

The event started with a series of presentations, opened by Michael Taylor from IRENA, who talked about the development of renewable energy costs, which have fallen dramatically in the last 10 years, partially due to the introduction of auctions for renewable energy supportJust like administratively set support, auction-allocated su.... Afterwards, Robert Brückmann from Eclareon presented the most recent findings on Weighted Average Cost of Capital (WACC) developments for onshore wind energy in Europe. From his presentation it clearly emerged that WACC decreased in 2016 in comparison to 2014, but the reasons for this reduction are different for each member state. Finally, Florian Egli from ETH Zurich presented his work on learning effects and their contribution to the decrease in costs of capital in Germany over the last 20 years.

The presentations were followed by an interactive discussion session, based on the so-called World Café format. The participants thus joined into groups and engaged in a very active debate about the effects of individual auctionAn auction is a market mechanism with the aims of allocating... design elements on financing conditions.

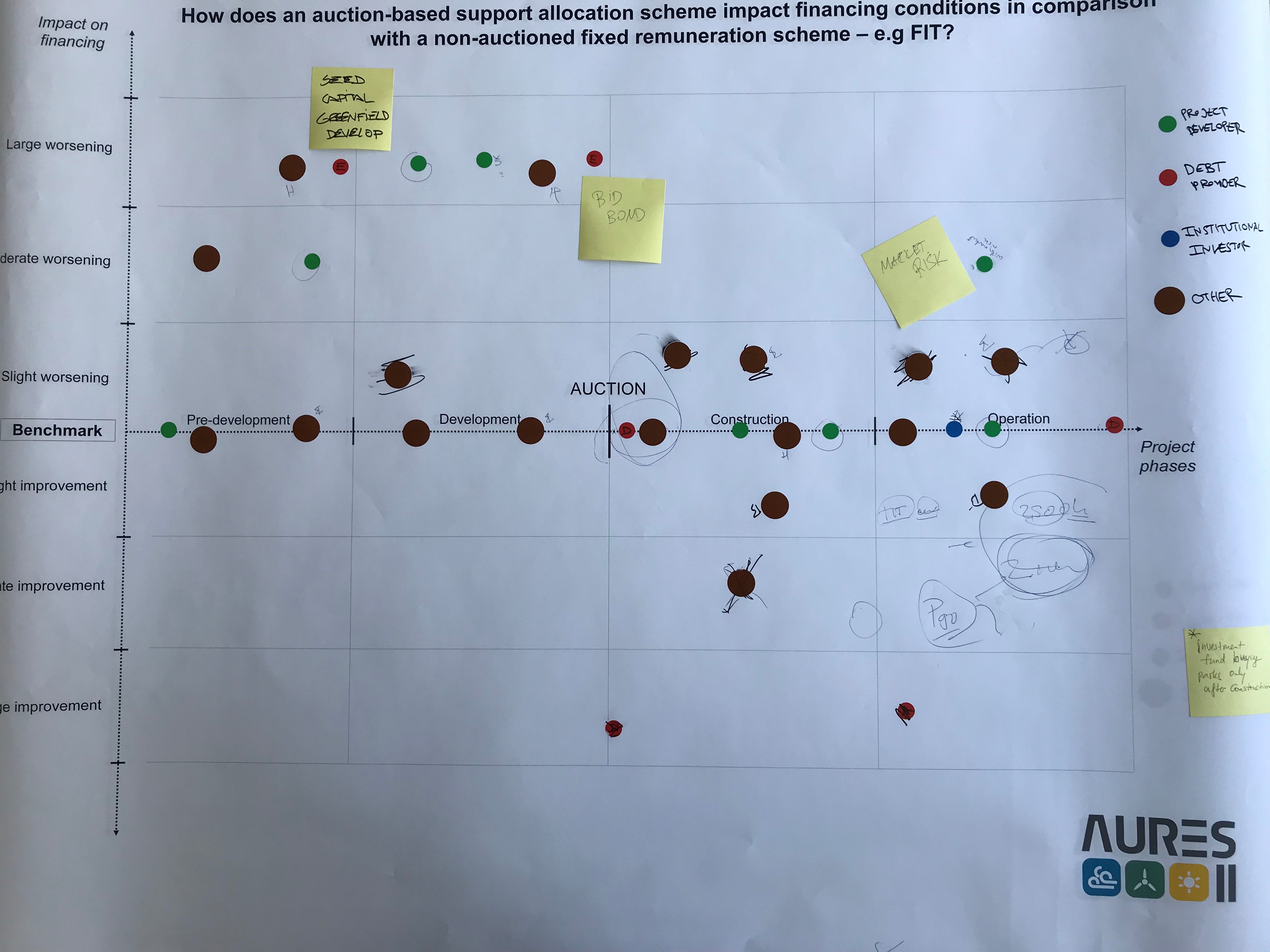

The activity revolved around a plotted chart (see the image above) that was given to each group. The chart shows on the vertical axis the magnitude of impact on risk in comparison to a benchmark, while the horizontal axis shows the different project development time phases. The participants were asked to place colored sticker dots on the chart, knowing that each color represented a different kind of actor (red – debt providers, blue – equity investor, green – project developer, brown – other). By doing this they evaluated how auctions impact risk in each project development phase. The participants were then asked to explain why they chose to place the dots the way they did, and were encouraged to elaborate on which auctionAn auction is a market mechanism with the aims of allocating... design had influenced their decisions.

In the end, most of the participants agreed that bid bonds cause higher risk in the development phase, due to greater financial pressure on participating companies. The highest risk in general, instead, is expected from the remuneration designs during the operating stage. Finally, penalties seem to have a smaller effect on risk.

The workshop resulted in precious feedback on the effect of auctionAn auction is a market mechanism with the aims of allocating... designs on risk, which will be used to form the conclusions of the Task 5.1 report.